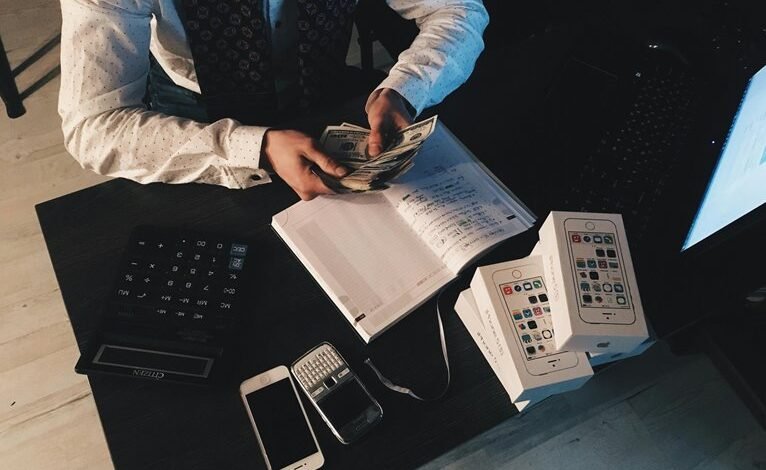

Financial Growth With Bookkeeping 346-837-5187

Effective bookkeeping is crucial for financial growth, providing a solid foundation for decision-making and strategic planning. Accurate records enable businesses to comply with regulations and manage tax liabilities. Tailored services can cater to specific industry needs, promoting efficient resource allocation. This creates opportunities for enhanced cash flow and stability. However, understanding the full impact of these practices requires further exploration into the methods that drive success.

The Importance of Accurate Bookkeeping

While many business owners may overlook the nuances of bookkeeping, its accuracy is paramount for financial growth.

Accurate bookkeeping ensures business compliance, mitigating risks associated with audits and penalties. Furthermore, it streamlines tax preparation, allowing owners to maximize deductions and minimize liabilities.

Tailored Services for Every Business

Recognizing that every business has unique financial needs, tailored bookkeeping services can significantly enhance operational efficiency and contribute to sustainable growth.

By offering customized solutions that address industry-specific needs, businesses can streamline their financial processes.

This adaptability allows companies to focus on their core operations while ensuring that their financial management is aligned with their strategic objectives, fostering long-term success.

Making Informed Financial Decisions

Effective financial decision-making is crucial for businesses striving to achieve growth and sustainability, as accurate data and insights enable leaders to navigate complex market dynamics.

By conducting thorough budget analysis and implementing robust expense tracking, organizations can identify trends, allocate resources efficiently, and mitigate risks.

These informed choices empower businesses to seize opportunities, optimize performance, and ultimately enhance their financial standing in a competitive landscape.

Enhancing Cash Flow and Financial Stability

A solid financial foundation is imperative for businesses aiming to enhance cash flow and achieve long-term stability.

Effective cash management strategies, coupled with accurate revenue forecasting, empower organizations to anticipate financial needs and allocate resources efficiently.

Conclusion

In conclusion, effective bookkeeping is essential for fostering financial growth, as it provides the foundation for strategic decision-making. A staggering 60% of small businesses fail within the first five years, often due to poor financial management. By implementing tailored bookkeeping services, businesses can not only enhance cash flow but also ensure compliance and optimize resource allocation. Ultimately, investing in accurate financial records can significantly increase the chances of long-term success and stability in a competitive marketplace.